Market Status

The charts will be updated by

every

Saturday. When no change to text, [NC] will be used.

Stocks above their 50-day Moving Average

[NC] This chart shows the number of Nasdaq stocks

that are above their 50-day moving averages. The

horizontal lines at 20 and 75 are arbitrary, and sometimes tend to

indicate when a move is nearing an end. The Nasdaq

composite index ($COMPQ) is shown below on a percentage scale for

correlation.

[NC] When this indicator is near a

high extreme, it indicates an overbought market, but the market

can continue up. A drop near 20 indicates a very oversold market.

[NC] The

April 2023 high in the Nasdaq ($COMPQ) was not verified by the number of

Nasdaq stocks above their 50-day MAs. This is an indication that

the market will go lower. But maybe not as it went higher! In August there was a confirmation, not a divergence.

In 2024 the indicator was coming down from an overbought condition and the

market going up! Unusual. The

market was dropping fast in early April. The expected

correction to that drop turned into a new advance. The huge AI

stocks were dominating the index and moving up.

The majority of Nasdaq stocks moved up until December, especially the

large caps, as the

Republican wins in the election and the good earnings reports were

pushing

the market higher. Then a market dip has occurred due to the Fed speak,

and the concern that fewer rate cuts will occur in 2025. The concern

about AI and the simpler approach introduced by DeepSeek was

moderating, but now the concern over Trump policies, especially the

tarrifs, are causing a drop. Less than 33% of the Nasdaq stocks are

above their 50-day moving average.

Bullish Percent Index

[NC] The Bullish Percent Index ($BPSPX) for the S&P 500 stocks is shown together with the S&P 500 Index ($SPX) in dotted blue. The Bullish Percent Index takes a group of stocks and records the percentage of those stocks that have a Point & Figure Buy signal from their point and figure chart. The BPI for the S&P 500 stocks is shown over a 1.5-year period.

[NC] The green buy pole indicates when the index goes above 30. The

red sell pole indicates when the index goes below 70. These seems to be

a good indication of future market action. When the bullish percent went down in early 2024, the SPX continued up due to the large tech stocks that make up 35% of the index.

The up move ended and on April 3rd the index dropped below 70

indicating

a likely significant drop in the market. But again the bull traders

moved the market higher on good Fed news and encouraging earnings

reports. After

a correction to that advance, the market continued up. The

large-cap

stocks are now back in favor so the market has stayed up pretty well,

however the market has had a pull-back sparked by the Fed-speak, the

concern that fewer rate cuts will occur in 2025, and the uncertainly of

Trump actions.

Sector Bullish Percent

[NC] Looking at the BPI of sectors is a good way to get a feel

for how they are performing. Click here to see charts for ten S&P market sectors.

Volatility

[NC] The Volatility Index (VIX) shows the large-cap

market's expectation of 30-day volatility. The index is based on prices

of S&P 500 options that investors tend to rush to when they are

fearful of stock declines. The VIX is a widely used measure of market

risk and is often referred to as the "investor fear gauge". When the

fear is highest, the market is likely to bottom and start up as

all those in fear would have sold. There is greater detail at Investopedia.com.

[NC] Below is a one-year plot of the

VIX with the S&P 500 on a percentage scale at the bottom. In

the middle is the RSI of the VIX. When the RSI hits the blue 60

line there is danger of a decline (starts with a red

vertical pole). When the RSI hits 45, green pole, the

probability of making money in the market can be much better. All

indicators lag the market, and are not good in a choppy market. A green

pole will not be placed if the VIX is above 20, and a buy alert

will be canceled if the VIX goes above 20. Note also that low

points in the market usually occur when the VIX peaks.

A VIX Sell Alert,

based on the volatility of large-cap stock action, occurred on 2/24/2025

(red pole). The previous buy alert occurred on 1/24/2025 (green pole).

The traditional view is that

it is dangerous to be in the market when the VIX is above

20.

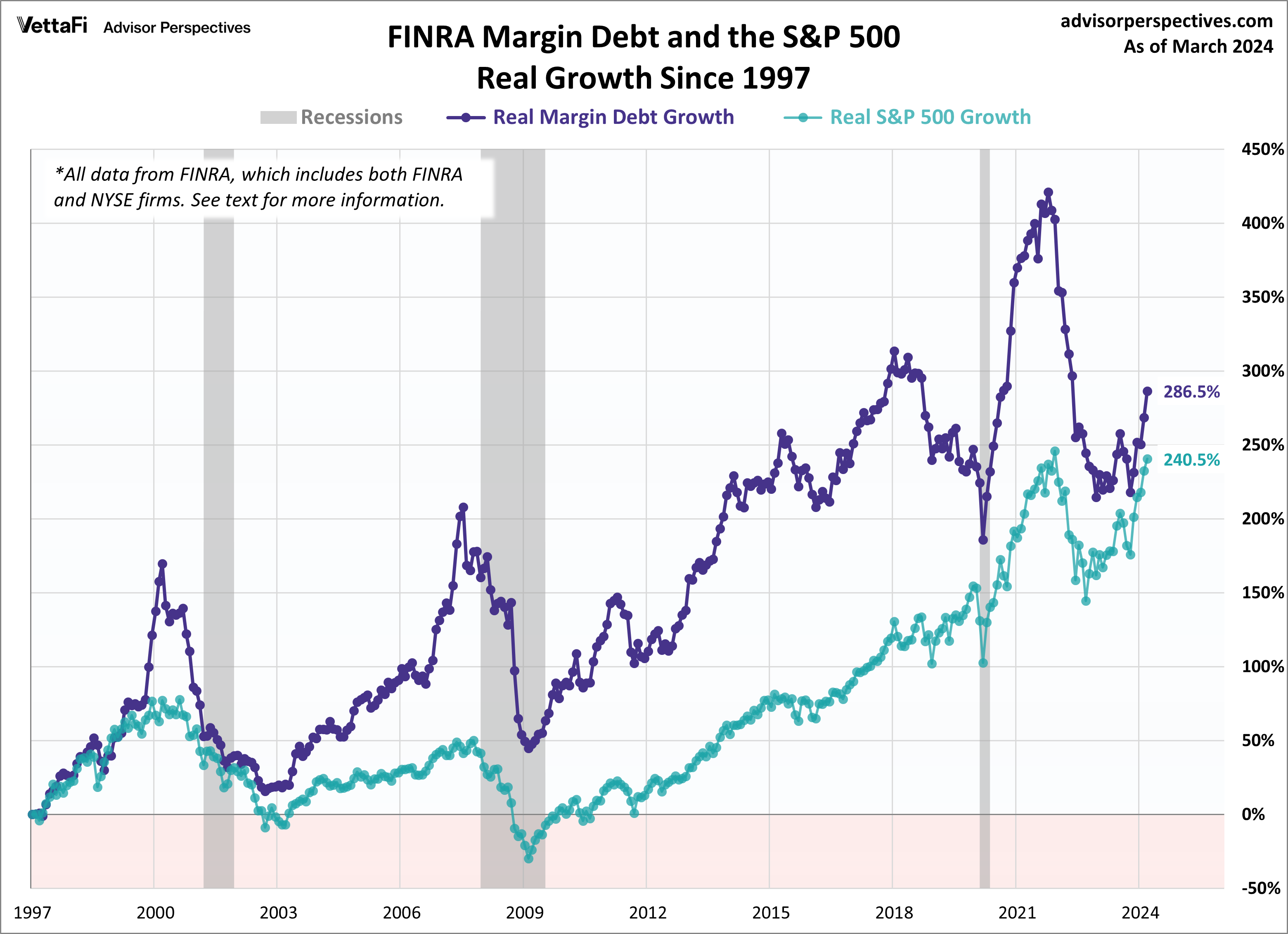

Margin Debt Impact

[NC] Notice the relationship of margin debt to the market.

This is the S&P 500 index. As Jill Mislinski states, "there are too few

peak/trough episodes in this overlay series to take the latest credit

balance data as a leading indicator of a major selloff in U.S.

equities. This has been an interesting indicator to watch and will

certainly continue to bear close watching in the months ahead."

This page is for amusement only, and should not be taken as advice to buy or sell anything.